Exceptional uncertainty

The pandemic, the war raging in Europe, the energy crisis and the tightening of relations between major powers are all making it exceptionally difficult to forecast economic turns.

The economic outlook for Finnish companies has collapsed back to the level of the financial and coronavirus crises. Profitability has weakened and demand has waned during the course of the late autumn.

“Finland has now entered a recession. How long and how deep this recession will be remains a mystery. On the other hand, the replenishment of European gas reserves is positive news in the midst of all the gloom,” says Sami Pakarinen, Director at the Confederation of Finnish Industries.

Waning demand and inflation-driven rising costs have led more companies to consider laying off staff.

The results of the Business Cycle Barometer indicate that economic growth will slow down considerably over the coming months. However, the global economy is weakening more slowly than it did during the pandemic, when economic growth stalled – yet also accelerated rapidly.

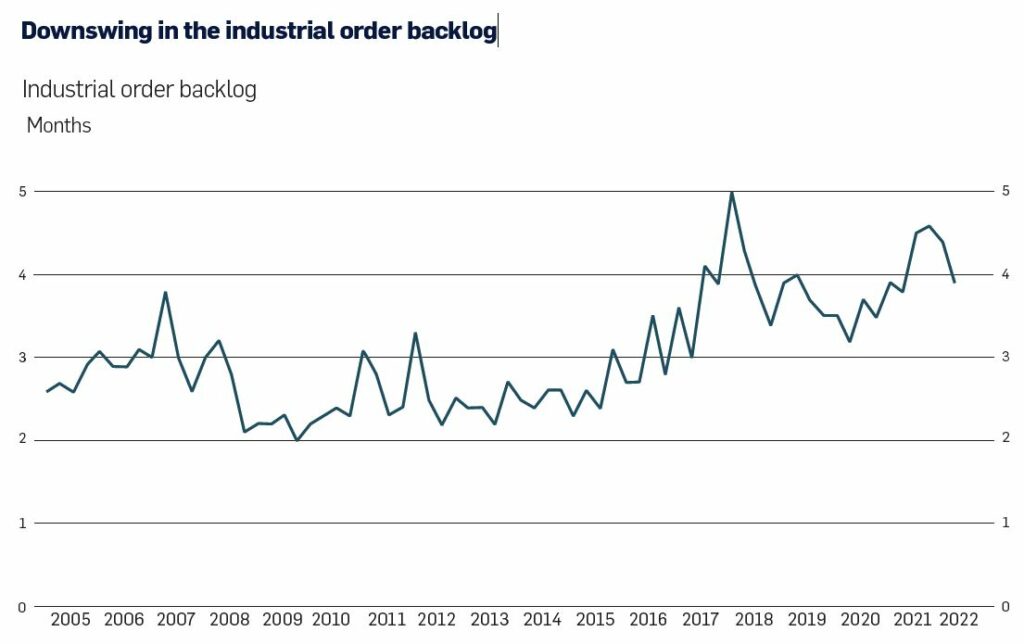

According to the Confederation of Finnish Industries, traditional economic indicators have been softening for a long time, but this softening has yet to be fully transmitted to the economy.

“Order books are already thinning in industry, and construction is being dampened by rapidly rising interest rates and an increasing supply of housing. Consumers’ purchasing decisions are weighing heavily in services, and projected economic growth largely rests on them. The big question is how well things will hold up if there is a downswing in employment,” says Pakarinen.

He predicts that the economic outlook will be particularly challenging both for the rest of the year and during early 2023.

“There are three key questions in the global economy: how well consumers in the USA can keep up with the Federal Reserve’s interest rate hikes; how things will develop in China with regard to coronavirus restrictions and the property sector; and trends in European energy prices and how the collapse in consumer confidence in Europe will affect consumption.”

“If one of these three fails, it will affect everything and the global economy as a whole. Which is why there is a great deal of uncertainty about the future.”

Only the service and retail sectors are expecting a slight improvement, although the business cycle in both of these sectors is still below the long-term average.

An abnormal normal

The rise in inflation and interest rates that has been expected since the financial crisis is now happening in an unexpected environment. The abnormal period following the 2008 financial crisis was marked by non-existent inflation, negative interest rates, and central banks’ stimulus measures, which were further intensified during the pandemic.

It was only a matter of time until there was a sharp rise in inflation. The abnormal era that has shaken financial markets for almost 15 years eventually came to an end when Russia invaded Ukraine.

Has the market now returned to normal?

“There is no definite answer to this. The turnaround has come so quickly that it’s creating uncertainty. It’s no wonder that inflation is so high. The recovery measures taken during the pandemic were incredibly large,” says Pakarinen.

The return to normality finally took place in an abnormal and unexpected environment overshadowed by the pandemic and the war that broke out in Europe.

Bottlenecks in production chains, issues in maritime logistics and the energy crisis caused by the war have pushed inflation to an unexpectedly high level. A 15-year period of abnormal interest rates finally came to an end.

“It’s definitely good to get rid of zero interest rates. However, inflation is lasting longer than was initially expected. There’s uncertainty as to whether the situation can be kept under control,” says Pakarinen.

Tensions between China and the USA have also increased recently, which has in turn increased uncertainty about global economic development.

“In this sense, the situation is anything but normal. A new era is dawning. And it’s by no means certain which direction things are heading in or how challenging these times will be for us.”

German economy a cause for concern

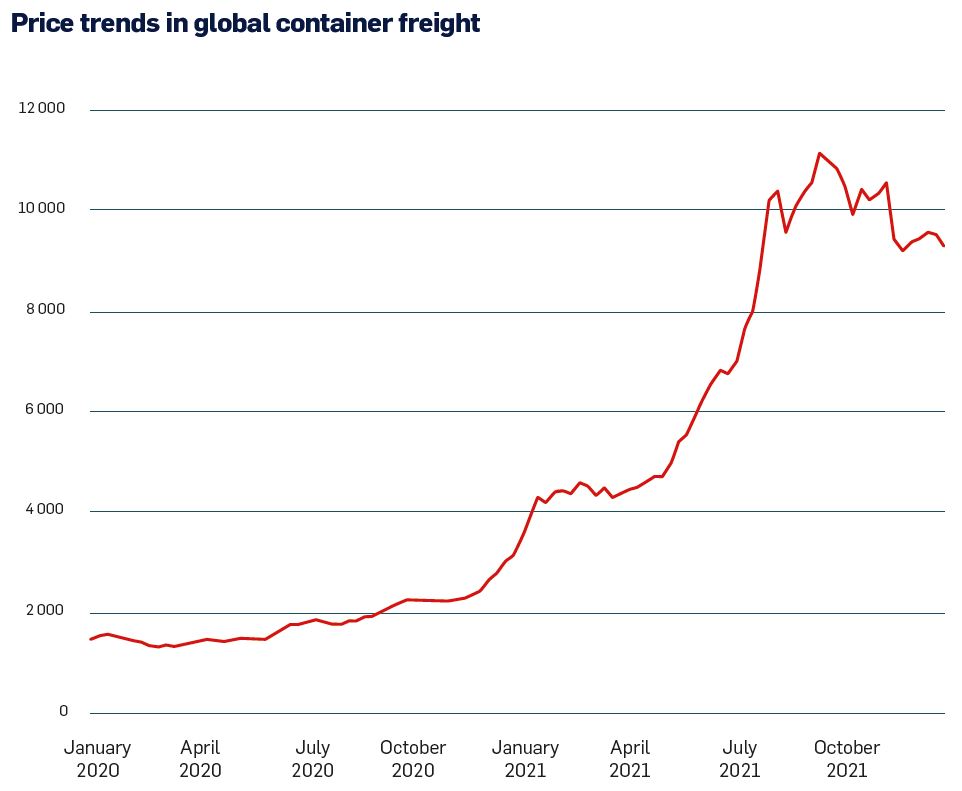

Economic growth potential is now being eroded by the aftermath of the pandemic. Home renovations have been completed, leisure-time purchases have been made, and no similar economic traction is expected from consumers. On the other hand, the pent up potential of the tourism sector was unleashed after restrictions were lifted. Yet as inflation rises, continued growth in consumption is unlikely. Ports are facing quieter times.

A new era is dawning. And it’s by no means certain which direction things are heading in or how challenging these times will be for us.

Sami Pakarinen

“There was such great traction in the consumer market during the pandemic that it will now inevitably be reflected as a decrease in consumption. Demand is shifting towards services, which are in turn being burdened by high inflation. This will without a doubt weaken global economic outlooks.” Growth forecasts have been lowered all across the board.

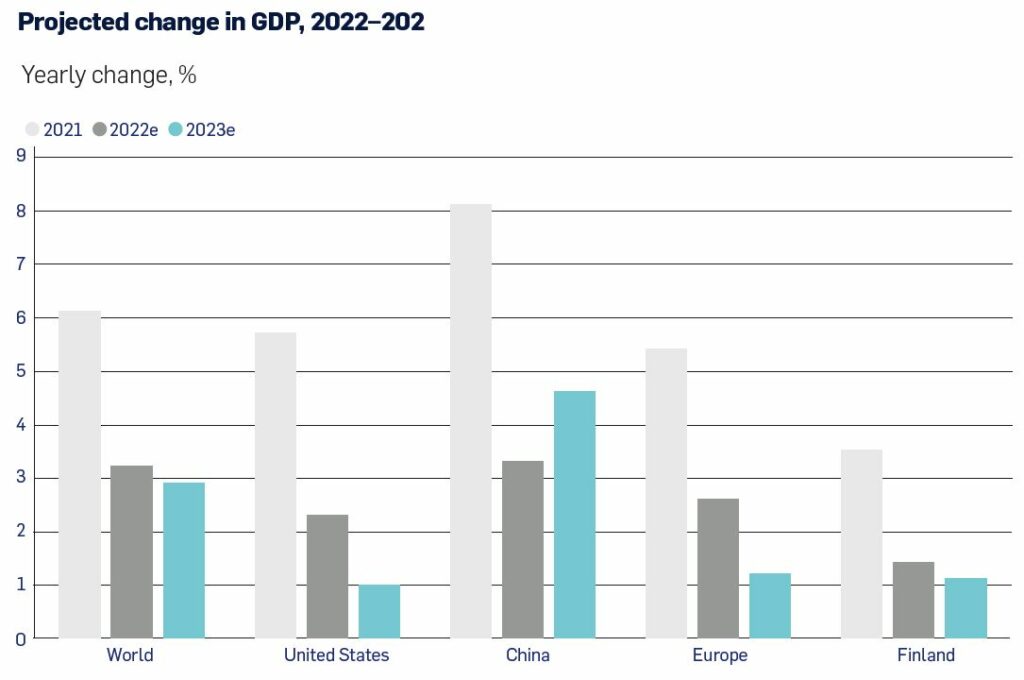

Yet in spite of the uncertainty, the growth forecasts for this year and next are positive in all major economic areas. The most significant changes in the IMF’s forecast are weaker growth in the USA during 2022 and poor economic growth in the euro zone being delayed until next year.

Finnish ports and export industries are now closely monitoring economic developments in Germany. The foggy outlook is reflected in the broad spectrum of different economic forecasts. Forecasts of Germany’s GDP in 2023 range from minor growth to the Deutche Bank’s estimate of a 3.5 per cent contraction.

A greater-than-expected contraction in the German economy would affect the entire euro zone and, therefore, also Finland. According to the Confederation of Finnish Industries, the twists and turns of the war and the energy crisis will have a major impact on the economy, in both the euro zone and Europe as a whole.

The price of maritime freight has started to fall, which already indicates a softening economic cycle.

“Maritime logistics has been experiencing a very strong boom since the coronavirus pandemic. The economic slowdown will now create strong price pressures over the next six months,” says Pakarinen.

The risks in Asian supply chains that were revealed by the pandemic have also prompted Finnish companies to increase their inventories and consider diversifying both their production and supply chains. This may also have an impact on maritime logistics in the future.

“It remains to be seen whether the maritime logistics issues we experienced during the pandemic will impact transport chains more extensively over the longer term. Will we see a larger shift to road transport?” Pakarinen wonders.

A recession is the price of stability

Pakarinen says that Finnish companies survived the collapse of the Russian market with only minor damage. During the ten years preceding the war, the proportion of Finnish exports accounted for by Russia fell from ten to five per cent.

“The effects would have been more significant ten years ago. Russian exports have halved over the past ten years. Of course, this figure will also vary from company to company. Yet companies have also managed to find new growth markets.”

The US Federal Reserve has indicated that the country’s economy needs to be driven into a financial recession in order to curb inflation. This will eventually affect the Finnish economy as well. Pakarinen says that a recession is a short-term price that must be paid to ensure longer-term stability.

“Maintaining price stability and the value of money are such important objectives that they override economic growth targets. In the longer term, it’s important to have a credible financial policy and for central banks to stick to their two per cent inflation targets.”